Starting a business can be the most enthralling experience you ever undertake. The ability to be the master of your own destiny has a huge draw., however start-up entrepreneurs should be aware the odds are stacked against them.

It’s estimated that sixty per cent of startups fail within five years and twenty percent will close within just 12 months. According to Companies House there were 726,735 dissolutions for FYE 2025, that’s the equivalent of 82 new businesses failing every hour.

There are a wide range of reasons why startups fail, however cash flow is commonly identified as the largest cause of concern for the majority of SME's. Often with inadequate resources,

risk management controls and resilience to market forces, startups are more often exposed to financial shocks than their larger competitors.

Effective risk management can seek to mitigate financial shocks to your business, while maximising the opportunities for growth. However, it's far too easy for startups to have tunnel vision in pursuit of their goals and not consider risks that can cause their business to fail.

What's behind the statistics?

PwC analysis found that in 2024, startups accounted for 46% of total insolvencies, which actually marks a decade-low failure rate suggesting relative resilience despite record company formations. This reasearch defines startups as firms within their first seven years of incorporation.

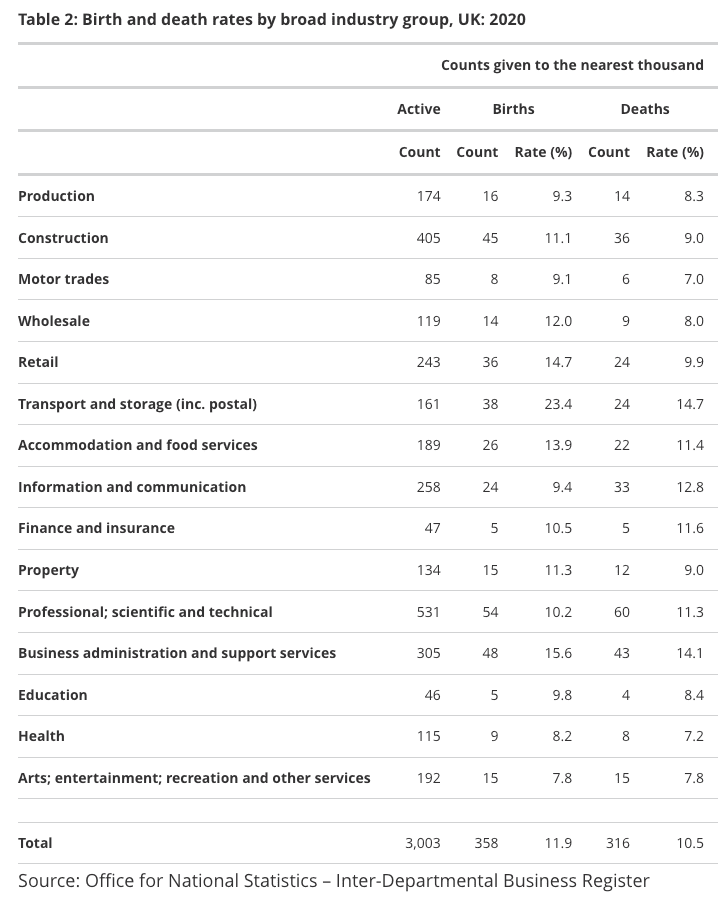

Survival rates vary considerably by industry, with the Transport/Storage sector the highest at (14.7%), followed by Business Adminstration at (14,1%). Whilst, Motor Trades at (7%) and companies working within the Health sector at (7.3%) had the lowest.

Strategies to help improve startup survival

The early years of a startup are a balancing act between innovation, market adaptation, and financial stability. While no strategy can guarantee success, research and experience show that certain practices dramatically improve the odds of survival in the UK’s competitive business landscape.

Validate demand before scaling

A high number of UK startups fail because they build products or services before confirming whether there’s enough demand. This “solution in search of a problem” can cause a lot of startups problems.

Manage cash flow effectively

Cash is the lifeblood of any startup, failiure to manage is the is the surest way to kill your startup. Preferably you don't want to sign any long term agreements unless absolutely necessary, whilst keeping your spending to a minimum.

Seek to build for stable business

UK startup culture often idolises “unicorn” valuations, but high burn rates can often lead to collapse. Businesses should focus on sustainable profit margins over rapid scaling, whilst maintaining reserve funds and

business insurance to guard against financial shocks.

Choosing the right sector at the right time

Unfortuantely noone has a cystal ball, but ask yourself the question "how well do I know the industry and what's the outlook?'. Focusing on niche markets with less competition can be a way to obtain a foothold in the industry.

Risk management

Growth and innovation will often take up the vast majority of your time, however the importance of survival and risk management should not be understated. As a subject matter expert within your industry, you are best placed to consider what internal and external forces can negatively impact your business.

The below risk management process is a simple and effective approach to manage the potential risk of startup failure:

1. Identify risks to your business

2. Analyse and measure the impact

3. Decide which risks are unacceptable

4. Reduce or transfer any unacceptable risks

5. Monitor and review

If the potential cost is greater than your risk tolerance level, consideration should be made to how you can avoid or mitigate the risk to an acceptable level. There are a number of tools available to guard against startup failure, a risk register for example can assist with recording and monitoring emerging risks within your business.

Business insurance

No one wants to purchase

startup business insurance and in the early phases of growth the additional expenditure on something you hope you will never happen can feel counterproductive. However, protecting your balance sheet and having sufficient resource to access legal support should something untoward occur, can make all the difference between a successful and failed startup.

Business insurance is an effective risk transfer mechanism for low frequency, but high severity events that can cause significant financial distress. The pooling of insurance premium provides a cost-effective means to protect your hard work and time you’ve invested.

Below are examples of risks that startups face that can be effectively transferred:

• A 3rd party claim for an employee that slips and falls down the stairs

• A 3rd party claim for damages arising from a breach of contract

• A 3rd party claim for accidental personal injury to a member of the public

• Damage to costly equipment that your business relies on to operate

• A 3rd party claim for injury or property damage from a product you supplied

• An investigation and fine by a regulator that alleges your non-compliance

• Property damage to your premises as a result of a fire, flood, storm, ect

• The cost of not being able to trade as a result of a fire, flood, storm, ect

• Theft of personal data and being held to ransom to make a financial payment

• A social engineering scam means you make a payment to the wrong person

Startup failure can occur for a vast number of reasons, however there are a number of risks identifed above you can easily protect your business.

We recommend you discuss your requirements with an insurance broker to consider the availability of products to assist with protecting your balance sheet. For a reasonable cost there are protections available that can provide financial and legal support when your business requires it most.

Originally posted by Get Indemnity

This guide is for information purposes and based on sources we believe are reliable, the general risk management and insurance information is not intended to be taken as advice with respect to any individual circumstance and cannot be relied upon as such.